Finances are something you have to take seriously no matter what part of life you are in. If you have been lucky enough to get out of the pandemic relatively unscathed, then you are one of the fortunate ones. Now, more than ever is a great time to look into some personal finance services that are available.

What Are Personal Finance Services?

Personal finance is the individual or family financial management performance in regards to sticking with a budget. The idea is to save money over time, while at the same time spending money on certain resources that are needed and allotting a certain amount for each living expense.

Future life events and various financial risks are also taken into account.

The above can be done on your own, or you can choose to use a personal finance service that will provide you with home budget software and more tools to help you follow a plan.

There are all sorts of personal finance services available. They come in the form of software programs, apps, and even companies that offer face-to-face instruction.

What to Consider When Looking at Different Personal Finance Services

There are several things you want to consider when you start the process of looking at the best personal finance services available.

What types of budget tools and budget programs will each service offer? Are they affordable and fair with their pricing tiers? Do they provide excellent customer service and other options for troubleshooting?

All of these are important things to consider.

It is also a good idea for a family or individual to consider the range of other banking and product options that may or may not be available through these different personal finance services and apps. Some of these to consider include:

- Checking Accounts

- Savings Accounts

- Credit Cards

- Loans

- Stocks

- Bonds

- Mutual Funds

- Life Insurance

- health Insurance

- Disability Insurance

- Income Tax Management

- Available Retirement Plans

You can see that having access to any number of budget plans along with the available tools will allow you to construct a much more viable plan for you and your family in the long run.

All of these things considered, let’s take a look at some of the best personal finance software that is available today.

Best Personal Finance Services

There are several excellent personal finance services and apps online. The key when you are trying to make a decision is to know where to start. Every service on the list below is a solid service and will give you a lot of different budgeting tool options and financial services.

Hopefully, this gives you a great place to start looking, as these are all ones that you can dive into and compare.

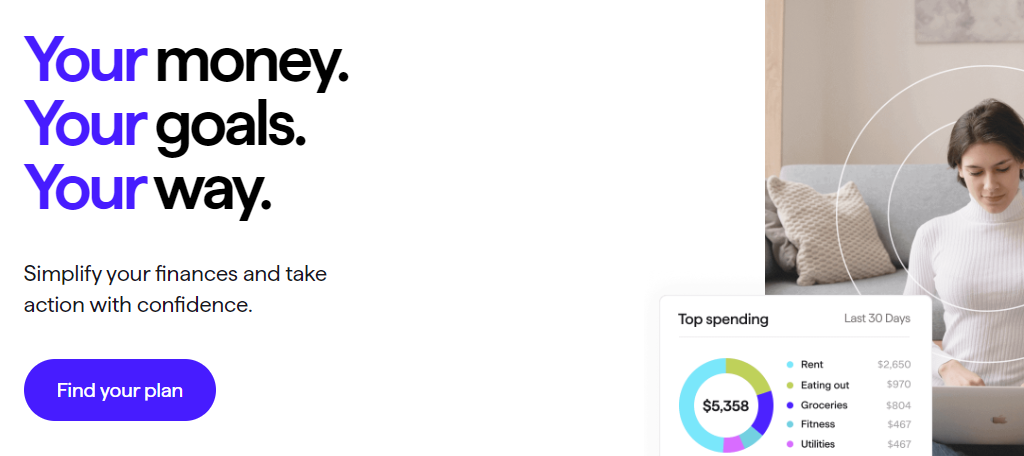

1. YNAB

YNAB also known as “You Need a Budget,” has a primary goal of helping you create a budget that will help you to stop spending money where you shouldn’t be. They want to make sure you don’t have to live paycheck to paycheck, and they give you all the tools needed to do this.

The service is quick and easy to install, supports almost all transactions and downloads from every bank, and allows you to easily configure the program whether it’s for personal or business use.

If you find that you have gotten off track while using YNAB, the program helps you get back on track by showing you what went wrong and what to do to fix it. Sticking to a budget is not easy, but YNAB makes the process and journey smoother.

Benefits

- Free trial

- Easy to install

- Personal and business use

- In-app prompts for budgeting

- Color-coded questions to curb spending

- Flexible

- Clear user reports

- Excellent tutorials section

Pricing

- Monthly Plan: $11.99/month

- Annual Plan: $84.00/year

2. Quicken

Quicken is another one of the best personal finance services available out there today. Chances are you have either already heard of or used them in the past. They are extremely popular and have a long-established reputation for their desktop functions.

However, they have recently extended functionality and they have an available app that works great on mobile devices.

Quicken offers quite a few really good financial reporting tools that you can use to get your finances in a better place. Need to create a budget? Need to take care of some bills? Or maybe you are interested in some new investments?

Whatever it may be, Quicken has you covered.

View bills, pay bills, and see what you have left over quickly and easily. Quicken also shines when it comes to potential investment opportunities. You will be able to track all savings, investment portfolios, and 401k and pension plans.

This gives you a clear idea of exactly what you have.

If you are looking for something that helps you build a budget, but also goes several steps further by providing banking and investment reporting into a dashboard, then this is worth checking out.

Benefits

- Solid and fair pricing

- Easy to install

- Secure online backup

- Desktop and mobile

- Desktop, app, and website sync

- Track investments with scheduled reports

- Transaction tracking

- Excellent customer support

Pricing

- Starter: $35.99/year

- Deluxe: $31.19/year

- Premier: $46.79/year

3. Banktree

Coming in third on our list of the best personal finance services in Banktree. While this software may not have the prettiest interface to look at, there is no denying that it is powerful and useful.

Where Banktree shines is the ability to offer balances in multiple currencies rather than rounding them off into a single total.

The software is also perfect for keeping track of literally everything. It gives you the ability to scan receipts with its mobile app and import them later on. Even though the software is more awkward than some of the others on this list, it does produce amazing reports which you can break down by time, or by the payee.

They also gave a 30-day free trial. You can use this time to get used to the layout of the software and see if it is right for you. Give Banktree a look. What they lack in sophistication they make up for with features.

Benefits

- 30-day free trial

- Supports multiple currencies

- Very neat reports

- Desktop and mobile

- Scan receipts

- Track finances easily

Pricing

- Desktop Personal Finance Software: $40.00/year

- Desktop Personal Finance Software: $6.00/year per additional PC

4. NerdWallet

NerdWallet is a free tool that can help you track your financial progress and credit scores without having to fight through an army of ads. It helps you with everything from small business loans to managing your mortgage.

You can easily import your financial information from a multitude of platforms for quick setup.

NerdWallet also includes a variety of paid services you can take advantage of. For example, you can pay one flat rate to have your taxes done regardless of your situation. Or you can sign up for NerdWallet Advisors.

This service gives you one-on-one time with a certified financial planner to get advice about your situation and how to reach your goals. Overall the tool has something for everyone and since it is free, there;’s no harm in giving it a try.

Benefits

- Budgeting

- Track spending

- Manage small business, personal, and student loans

- Utilize Nerd AI to help answer questions

- Excellent security

- Free to use

Pricing

- Free

5. Moneydance

Rounding out our list of best personal finance services is Moneydance. Originally built for Mac users, Moneydance has since expanded to Windows and Linux and provides a unique and easy-to-use one-window interface.

Open the window and you get an “all in one place” view of your finances, upcoming bills, recent expenses, and much more. You can easily click on any item and see all the changes that have been made.

The product provides very strong reporting features. If you are an old-school money person, then you will enjoy the layout, as it resembles balancing and managing a checkbook.

There is no free trial of the product, but they do offer a 90-day money-back guarantee. So essentially you have three months to use it and see if you like it.

Benefits

- Strong reporting features

- 90-day money-back guarantee

- Transaction logging

- Single window interface

- Ability to run on multiple desktops

- Track all bills and expenses

Pricing

- One-time purchase: $49.99

Personal Finance Strategies

Managing your personal finances properly can be a tricky thing, especially if you are unsure where your money should be going and when it should be going there. Remember, you aren’t the only one who struggles with managing money.

Even the people who are great at it use solid personal finance services to make sure they are getting the most out of every aspect.

Oftentimes, it helps if you can devise a plan of strategy for your finances. There are several different types of plans out there. However, I like to narrow all the possibilities down to 10 main steps you can take toward a better financial future.

Create a Budget

Having a budget is one of the most important things you can do when it comes to gaining control of your finances. All of the personal finance services listed above can help you with this.

Create an Emergency Fund

Always pay yourself first. You can do this by putting money in an emergency fund. This fun can be accessed in the event of a money emergency.

Limit Debt

Yes, easier said than done sometimes. However, with discipline and other strategies, you can definitely limit the amount of debt you take on.

Use Credit Cards Wisely

Remember, most credit cards will try to real you in with cashback and points offers. Even if they look attractive, you should still use credit cards wisely. The interest rate can really creep up on you, even when it is low.

Keep Track of Your Credit Score

You don’t need to have a perfect credit score to live a good life. However, it is a smart idea to keep track of your score and make sure nothing pops on it that isn’t expected.

Consider Family

What does your family need? What might they need in the future? Always consider your family when it comes to building and protecting your finances.

Pay Off Student Loans

Yes, these need to be paid off. You went to school, you are obligated to pay them. Do your best to work with your loan carrier and get a plan in place to try and pay them off. Also, student loan interest is tax-deductible.

Plan and Save for Retirement

It is very important to plan and save for the later years of your life. Have a retirement plan in place. Make sure you have the right amount of money to live when you decide to retire and enjoy life.

Maximize Tax Breaks

Search high and low for any and all tax breaks you can find. If you need to hire a tax professional, then do it. Maximize all tax breaks to their fullest in order to drive down any payments you may have to make.

Keep a Fun Category

In other words, give yourself a break. Allow for fun purchases. Take vacations or get a new tv. It is important you allow yourself some breaks and fun.

Final Thoughts

All of the personal finance services above offer some different things, as well as some of the same. They all deliver a very important financial and budget tool that most consumers not only benefit from but need.

All of the services listed above are excellent. They will all give you every tool you need to get your basic budgeting and money in order. From there, the one you choose will be based on personal taste, as well as looking for the exact tools you may need.

Whichever one you decide to go with, you can be sure that all of the personal finance services listed above are top-notch services.

I hope this article was helpful. Use the list above as a starting point on your journey toward a better financial future. Good luck and happy hunting!

Great article! Especially liked the input about having a fun category. Does not need to be much, but think it is important to really succeed in saving money.

Thank you Yvette.

Personal financing is an idea to save money for the future and spend it only on certain resources that are needed and allotting a certain amount for each living expense.

Personal financing is an idea to save money for the future and spend it only on certain resources that are needed and allotting a certain amount for each living expense. Financial apps help one in investing in the right thing.